Two steps forward, One step back

We continue along our path to achieve health insurance for our family. On the good side, we updated our income with GetCovered NJ to get more subsidies and got our dental insurance issues ironed out. On the bad side, we suffered a big setback in getting insurance for our kids through NJ FamilyCare.

Updating Income on GetCovered NJ

We recently updated our income on GetCovered NJ recently for two reasons.

- Our expected annual income is higher now compared to when we first applied for health insurance. I sold some shares from an old Employee Stock Plan, forgetting that the sale would be counted as capital gains. There will now be an extra few thousand dollar increase in our AGI as a result. (Go me… sigh.) Mr. FireDesired got his final paycheck from work completed in March. This was unexpectedly large due to his vacation payout. Also, Mr. FD signed a contract for some remote freelance work. All in all, our expected income for the year went about $20k compared to what we estimated last month, so we figured that would change the amount of health insurance subsidies we would get and an update was in order.

- The most recent COVID-19 relief package passed by the US government, the American Rescue Plan, expanded subsidies for health insurance. In order to benefit from that, we needed to update our income on GetCovered NJ.

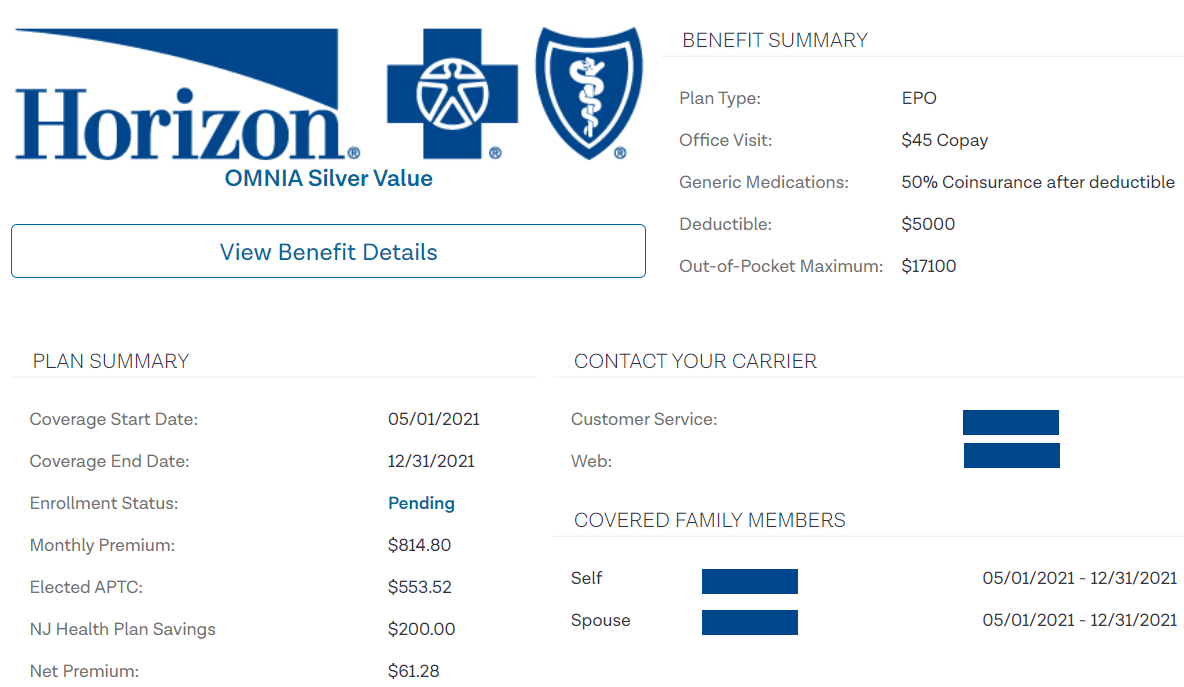

As a result, a few things changed on our side. We definitely benefited from increased subsidies, which pushed our monthly premiums lower. We now pay less than $62/month for our insurance. However, I believe the higher income we reported pushed our Maximum out-of-pocket amount, copayments, and deductible in a less favorable direction. Still, Mr. FD and I view insurance as something to prevent financial ruin if we run into health issues. We’re glad to have this option.

Dental Insurance for the Parents

We finally have basic dental coverage through a company called HealthPlex. On the GetCovered NJ marketplace, it’s called NJ Family Smiles. This is good news for us because our GetCovered NJ information wasn’t sent over properly to the dental carrier initially. We never got a bill or any correspondence from them until a few days ago, even though we applied mid-March. We had to make a few more phone calls to GetCovered NJ to get this figured out. We’re glad to finally have this part settled.

One MAJOR Setback

While things look good for us parents with GetCovered NJ, our kids’ insurance with NJ FamilyCare ran into a major setback. When we applied for health insurance through GetCovered NJ, we were automatically referred to NJ FamilyCare because our two kids were potentially CHIP-eligible. After a few rounds of letters requesting additional documentation and follow-up phone calls, NJ FamilyCare dismissed our application. This was not expected.

What happened? I’m not entirely sure, but this is what I can piece together. When they applied on our behalf for CHIP benefits, GetCovered NJ didn’t send over all the information from our application. They didn’t send over our reported estimates for contract/freelance income that Mr. FireDesired expected he would get. During one follow-up call to FamilyCare, I explained to the representative that Mr. FD might have income via freelance, but that it wasn’t finalized yet. That information apparently changed the situation so that our application was dismissed. We received a letter stating that we hadn’t sent in the required information, even though we sent all the information they requested of us.

When I called back to find out what went wrong, a different representative told us that GetCovered NJ doesn’t send a lot of information to FamilyCare when they apply on your behalf. As a result, they didn’t know about the potential freelance work, even though we documented it in our GetCovered NJ application. The rep said that because we mentioned the freelance, we needed to send in different documentation. I asked why we didn’t get a letter asking us for this information, and I was told this was the process. (She did apologize though. I think she did sympathize with us.) The representative advised us to apply for FamilyCare online ourselves, instead of allowing GetCovered to do it on our behalf. So, that’s what we did last week. We’re basically starting all over, and we don’t know if applying ourselves will really help things.

Another piece of information that I learned is that, while GetCovered NJ seems to base subsidies on expected annual income, FamilyCare works on a monthly basis. With Mr. FD’s freelance work, we’ll most likely have decent income for the next three month, followed by basically no income afterwards. I’m not sure what that does for us in terms of FamilyCare and eligibility. However, I’m hoping that we at least get an actual acceptance or denial this time.

Different Contingency Plan for the Kids

If we’re denied from FamilyCare, I’m hoping for a denial decision sooner rather than later. With a denial of coverage, we could at least take that back to GetCovered NJ and attempt to insure our kids on the marketplace. As things are now, we weren’t officially denied, rather we were “dismissed”. We’re still in limbo.

Another bit of information that we found out by calling NJ FamilyCare was this idea of Presumptive Eligibility (PE) , which allows for “temporary NJ FamilyCare health coverage while full NJ FamilyCare eligibility is being determined”. As it was explained to us, if ill fortune descends on us and we need to take our kids to the emergency room, we can do so and inform them that we have Presumptive Eligibility. I was surprised to hear about this. I didn’t know this was a thing.

To see doctors or dentists outside of dire emergencies, we can call FamilyCare for a few numbers and addresses of facilities within our county that will see our kids while they are still not covered by insurance. I have no idea how easy or difficult it is to go this route, but it was a bit of a relief knowing that this option even existed. I couldn’t find any written documentation on this, but I hope the reps know what they’re talking about.

We also recently received more information about Cobra benefits, and while it doesn’t look pretty, it’s still an option. There is in fact no option for us to just insure the kids, despite what we were originally told. Instead, our best option at this point is to pay about $1k/month to insure Mr. FD and the kids together. We have until the end of May to initiate this.

In the meantime, more waiting for us.

The administrative task of signing up for affordable health coverage in retirement is not something that I’m looking forward to! The subsidies are pretty nice right now, but I’ve heard it’s a pain to navigate the marketplaces from multiple FIRE sources (and it looks like that’s been your experience so far as well).

Wishing you the best of luck for a speedy and financially friendly resolution so that you can both finally enjoy some of that early retirement time together 🙂

Thanks for the well wishes! Achieving health insurance for everyone has been difficult, but we’ve recently got to a good point. It’s not perfect, but we’re glad about where we’ve ended up. The subsidies are much better than I thought they would be when we were originally planning for FIRE. I hope to write one more blog post about it soon. Then, I hope to NOT have to revisit health insurance again until the end of this year, when open enrollment happens again. Here’s to hoping, and thanks for stopping by!